South Africa must move with speed to implement its climate plan

The history of delays and corruption seen in large infrastructure projects in the past must be avoided at all costs

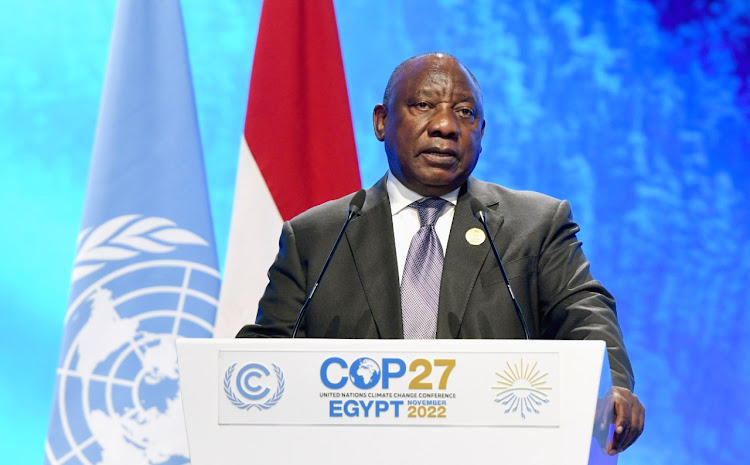

South Africa unveiled an initial five-year Just Energy Transition Investment Plan (JET IP) at the UN’s COP27 climate conference in Sharm El-Sheikh, Egypt, with a goal of decarbonising the economy in line with Nationally Determined Contributions by 2030.

The JET IP will focus on three priority areas, including electricity, new energy vehicles and green hydrogen, with an initial funding requirement of R1.5-trillion.

The government estimates that there is a R700bn shortfall. It’s a lot of money that the country needs and the plan was designed to be credible and realistic to attract the required funding.

As we have learnt since 1994 from the constitution, BEE policies and various iterations of economic policies, paper-perfect plans are not where the problem resides. It’s in the implementation of the plans that South Africa’s track record is dismal.

The JET IP will face the same implementation challenges of the past nearly three decades and must overcome them if South Africa is to be a global model of how to structure, fund and implement decarbonisation for emerging and developing economies.

First up are the details of the initial $8.5bn (R147bn) from the International Partners Group, which includes the US, the UK, France, Germany and the EU. Of the total funding, $330m is in grants, with nearly $200m coming from Germany, while the rest is distributed among the funding partners.

“The history of delays and corruption seen in large infrastructure projects in the past must be avoided at all costs”

Some $5.3bn will be concessional loans, with $1bn each coming from the EU and France. The US and the UK are not providing concessional loans; instead they will jointly provide $1.5bn in commercial loans. The remaining $1.3bn in guarantees is from the UK, which is the largest individual funding partner.

We now have the details of the split between grants and loans, which was the subject of debate when the initial announcement of this funding was made. Many expected Santa Claus to come bearing Christmas gifts of grant funding, and that is not the case.

Most of the funding is concessional loans (62%), 18% is commercial loans and 15% is guarantees. Only 4% is grant funding.

While concessional loans are better than commercial loans in terms of interest rates and terms, and they constitute most of the funding, poorer countries need more grants rather than loans.

However, advanced economies have strongly demonstrated that they are not interested in giving grants to help with a response to the climate change mess they have largely caused through their industrial development. Instead they want to make returns from the loans they give. They are in it to benefit financially. Oh well, that’s how global capital works.

Second and most importantly, South African authorities must move with speed to implement the JET IP, starting with the spending of the $8.5bn. Its success will determine whether South Africa remains the shining light it has been at COP27 as we continue searching for more funding to meet the Paris Climate Change targets of net zero by 2050.

Speaking with a senior diplomat, I got the sense that our policy implementation track record is cause for concern by international partners. There is a lack of belief that we have the capacity to implement, the organisational structure to ensure transparency and accountability, and the technical skills in the public sector.

Other emerging markets, including Indonesia, Chile and Brazil, are gearing up to be the model countries for a just transition, and if South Africa bungles the implementation, rich countries will simply change tack and look to those countries instead.

It is important for the government to move beyond the paper-perfect plan to implementation, to ensure that the funding continues coming beyond this $8.5bn test financing.

The history of delays and corruption seen in large infrastructure projects in the past must be avoided at all costs.